|

In this episode, Bayo Adelaja spoke with Helen Lin, Head of Innovation and Strategic Partnerships at FINCA Impact Finance (FIF), one of the leading microfinance organisations around the world.

Present in 6 African countries, FIF is creating socially responsible opportunities for Africans to access finance digitally as well as through branches.

FINCA Impact Finance is leveraging the power of technology to expand financial inclusion, putting financial power in the hands of or around the corner from our customers, no matter where they live.

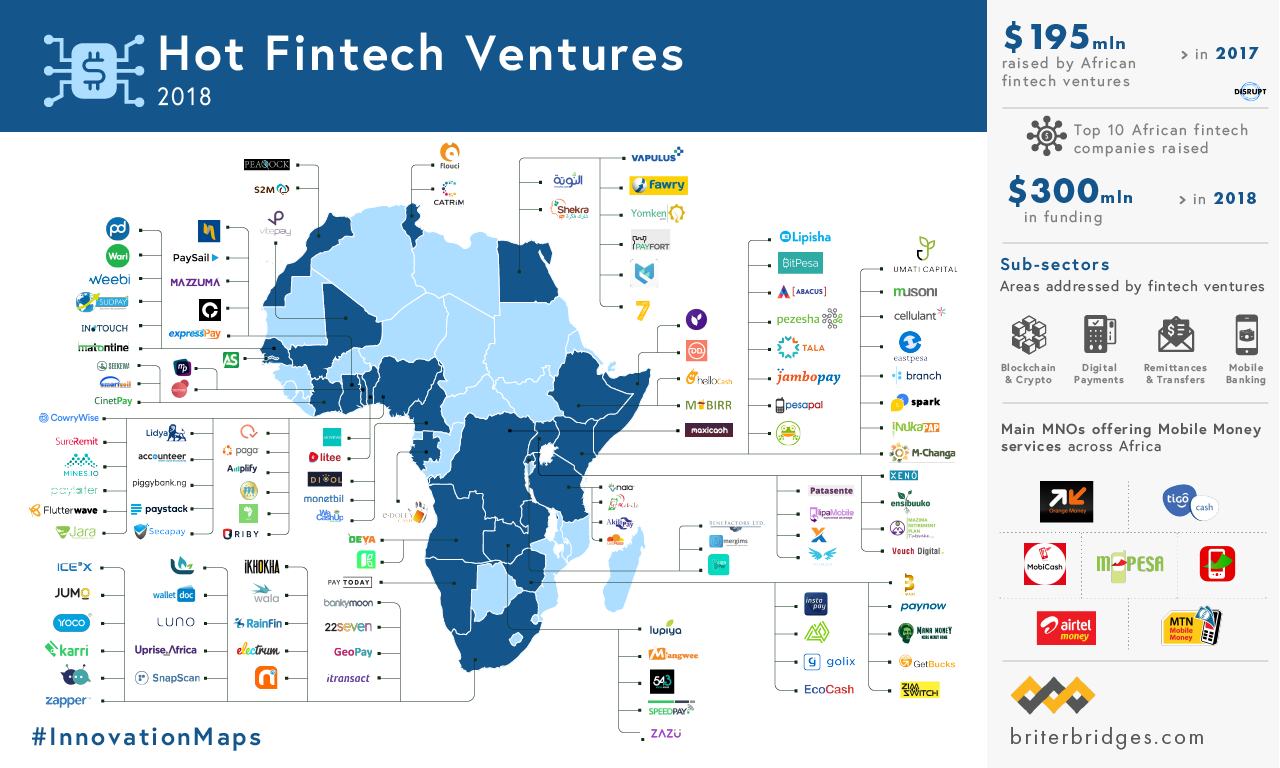

Financial inclusion has seen unprecedented growth over the years and it shows no signs of slowing. According to research carried out by the Mastercard Foundation, “in 2011 the level of financial inclusion in Sub-Saharan Africa was just over 23 percent. In 2017, it was almost 43 percent, with a significant increase coming from digital financial services.” Read more. According to Findex, while the share of adults in Sub-Saharan Africa with a financial institution account barely budged, the share with a mobile money account almost doubled to 21 percent. In every other region of the world, mobile money use is lower than 10 percent.” Read more. This growth is due to the growth of “hot fintech ventures” across the continent, some of which are included in the 2018 Briter Bridges sector map below.

However, the innovation being carried out by large scale institutions like FINCA Impact Finance is the bedrock of the move towards financial inclusion. We had a fantastic conversation about the transition to branchless banking, which Helen covers in more depth in this report.

As Helen rightly points out in the interview, traditional banking institutions are still best equipped to navigate the regulatory aspects of very difficult markets Lean in as we have a no holds barred conversation with a verified shaper of Africa’s finance industry, Helen Lin. Comments are closed.

|

Archives

September 2023

|

RSS Feed

RSS Feed